Car Insurance Cincinnati Fundamentals Explained

Wiki Article

What Does Cincinnati Insurance Company Do?

Table of ContentsAuto Insurance Cincinnati Fundamentals ExplainedThe Definitive Guide to Car Insurance CincinnatiNot known Details About Boat Insurance Cincinnati The 9-Minute Rule for Cincinnati Insurance CompanyThe Auto Insurance Cincinnati IdeasFacts About Boat Insurance Cincinnati Revealed

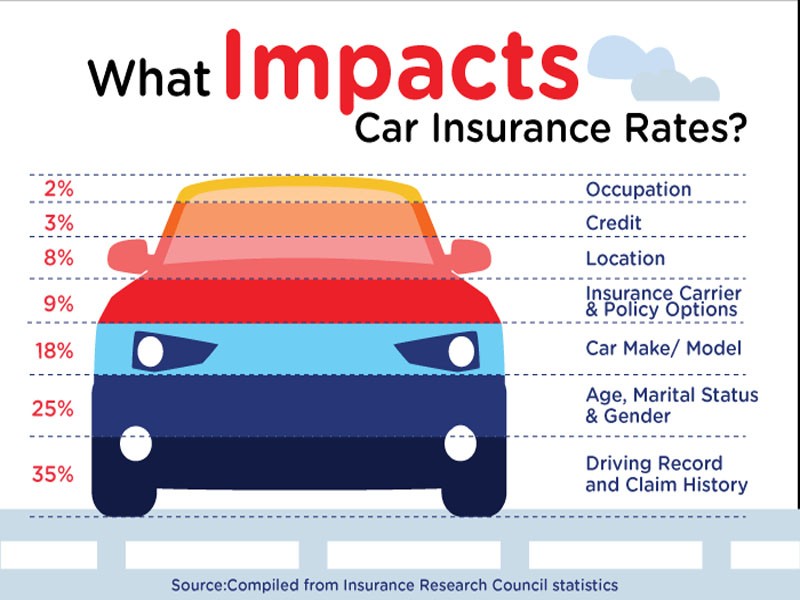

Car insurance policy has you covered when crashes happen. Let's state you're at a traffic signal and a distracted driver fails to quit in time as well as strikes the back of your vehicle. If you didn't have cars and truck insurance policy, you would certainly need to pay of pocket for any damage to the car.Automobile insurance policy works by giving economic protection for you in the event of a mishap or theft. Car insurance coverage costs have a look at numerous variables based upon you, your lorry and also your driving history. A few of which may include: Driving document Basically, the much better your driving record, the reduced your costs.

These services and products are provided to Wisconsin citizens. Car insurance secures not only you, however additionally passengers, other motorists, and pedestrians. It likewise offers protection for damages to your vehicle as well as various other individuals's residential property. Just how much insurance coverage and what kind of coverages you require will certainly rely on your situation.

Getting My Car Insurance Cincinnati To Work

It does not spend for bodily injury you may sustain. Residential property damage, This protection safeguards you if you are at mistake for damage to an additional individual's home, such as an automobile, its materials, or other residential property you damage in an accident such as a garage, residence, fencing, or trailer. Clinical repayments, Clinical settlements insurance coverage pays for needed clinical care for you or others covered by your policy resulting from a crash.A higher deductible decreases the possibility that your standing with your insurance provider will certainly be impacted. If you have a low insurance deductible which creates you to send a variety of small claims, your premiums will likely increaseor your protection could also be ended. Your capacity to pay the insurance deductible is an important factor to consider when choosing a level that is best for you.

/cloudfront-us-east-1.images.arcpublishing.com/gray/RTAO57GZVBCZPNGSKPXLZB7Z7U.jpg)

Not known Facts About Boat Insurance Cincinnati

This price cut program advantages those that have actually been insured by WEA Home & Casualty Insurance policy Firm for three or more years. This discount applies when a participant renews his or her policy.Unlike many various other insurance policy companies, we do not tell you where to get your vehicle fixed. Usually, the only time you hear from your insurance company review is when your costs is due.

We perform regular policy reviews that aid you reveal how changes the original source in your individual life might impact your insurance coverage needs. We value your commitment. If you are in a mishap as well as you have actually been guaranteed with us for 5 or more years with no previous accidents or tickets in the household, we will certainly forgo the accident additional charge.

Little Known Facts About Cincinnati Insurance Company.

If you hurt a person with your vehicle, you might be demanded a great deal of money. The amount of Liability protection you bring ought to be high enough to protect your assets in the occasion of a crash. The majority of specialists suggest a limitation of a minimum of $100,000/$300,000, yet that might not be sufficient.

If you have a million-dollar house, you might shed it in a legal action if your insurance coverage is inadequate. You can obtain added insurance coverage with a Personal Umbrella or Personal Excess Liability policy (auto insurance Cincinnati). The better the worth of your assets, the more you stand to lose, so you need to purchase obligation insurance coverage suitable to the value of your possessions.

10 Simple Techniques For Cincinnati Insurance Company

You do not have to figure out exactly how much to purchase that depends on the car(s) you insure. The greater the deductible, the reduced your premium will be.

Comprehensive insurance coverage is usually marketed along with Crash, and also both are commonly described with each other as Physical Damage coverage. If the vehicle is leased or financed, the renting business or lending institution might need you to have Physical Damages coverage, also though the state regulation might not require it. Covers the cost of healthcare for you and also your guests in case of a crash.

Some Ideas on Boat Insurance Cincinnati You Need To Know

Therefore, if have a peek at this site you pick a $2,000 Medical Cost Limit, each traveler will have up to $2,000 insurance coverage for medical cases arising from an accident in your lorry. If you are involved in a crash and the various other vehicle driver is at fault yet has too little or no insurance coverage, this covers the gap between your prices as well as the other chauffeur's insurance coverage, up to the restrictions of your insurance coverage.Report this wiki page